Online Credit Card Management FAQ’s

With our convenient Online Credit Card Management system it's easy to manage your 1st CCU Visa credit card account:

- Lock and Unlock your Credit Card

- Pay your Credit Card Bill

- View Credit Card Transactions

- View Pending Authorizations

- View Card Balance, Credit Limit, & Available Credit

- View Current And Past Statements

- See your CU Rewards balance

To get started, log into 1st CCU Anywhere Online or Mobile Banking, click on your credit card in the Accounts section, then select “Credit Card” from the list of options.

Use the icons in the upper right corner and along the right-hand side of the screen (or on a mobile device these icons may be at the bottom of your screen) to navigate throughout the website.

View Your Transactions List

- A dropdown menu is provided to help you filter your transactions: select 'Recent Activity, All Transactions, a Specific Date, etc from the dropdown

- Transactions can be sorted by All, Pending, or Posted

- To view more details about a transaction, click on the small arrow to the right of the transaction, which will expand the box to provide name of the merchant, city, state, and zip, and purchase date

- Cardholders may Export their transaction list to an Excel or CSV file by clicking the Export link in the top right tool bar of the Transactions section. You also have the option to Print the list by clicking the Print icon in that same area in the top right of the Transactions section.

Your Account Profile

- Cardholders may edit phone numbers, email address, and street address by clicking the Profile icon in the upper right corner of the Account Summary screen.

- In the Profile section you have the option to select 'My Profile', 'Account Profile', or 'Manage Cards'

- To change your contact information (phone and email), Login Information (password), or Security Questions/Answers, please select 'My Profile'

- Cardholders can add, remove, activate and change the default card by clicking the 'Manage Cards' link in their Profile

More About Navigation Within The System

- Icons located in the upper right corner (when viewed on a mobile device these options are listed in the menu at the top left)

- Profile icon to edit your contact information, secondary authentication questions, user name and password, and manage cards

- Services icon: This option allows you to Nickname your credit card, Request A Replacement Card or Remove A Card.

- When you click 'Request Replacement Card' you will select the appropriate radio button next to the reason for the replacement, then click 'Next'. Verify the card information is correct, select the appropriate radio button, and then 'Submit'. A pop-up box will confirm that your request has been received.

- When you click 'Remove A Card' you will be asked to read the pop-up box to ensure you want to proceed with removing the card, then click 'Remove'

- Logout icon to log out

How Often Is Credit Card Information Updated On The Site?

Account balance, available credit, payment information, and transaction information are updated at least nightly on regular business days.

Additional Icons

- Make Payment icon takes you to the payment screen.

- Payment Activity icon allows you to view payment history.

- Statements icon allows you to view your credit card statements.

- Lost or Stolen icon takes you to the interactive screen for reporting a card lost or stolen. Complete all the required information, then review the information you provided before submitting.

To Leave Online Credit Card Management And Return To 1st CCU Anywhere:

- You can either click the Logout icon in the upper right corner of the screen (blue arrow) and then click on the 'X' in the upper left corner of the screen, OR, you may simply click the 'X' in the browser toolbar in the upper left corner of the screen. (Please do not use your 'Back' button on your phone or desktop computer to exit the Online Credit Card Management system)

- For security purposes, whenever you are resuming your activity in 1st CCU Anywhere after visiting the Online Credit Card Management system, you'll be asked to enter your 4-digit 1st CCU Anywhere PIN to verify your identity.

- Once you've entered your 4-digit PIN you will see the Credit Card account option list and you can click the arrow in the upper left corner of the screen to return to your 1st CCU Anywhere Dashboard.

Activating A Card

- To activate a new or replacement credit card, log into DX Online.

- From the Account Summary page, click on the 'Activate' button. The Activate Card screen will display.

- Select the Card Expiration Date from the drop-down menu and click 'Submit'

- The success message will display. Click the 'Close' button to return to the summary page.

Lock/Unlock Credit Card

- Credit Card Lock/Unlock (padlock icon located on the card art image)

- Cardholders can lock and unlock their card easily by clicking on the padlock icon which is displayed in the lower left corner of the card art

- When the lock has a green background the credit card is Unlocked

- When the lock has a red background the credit card is Locked

- To lock your credit card so it cannot be used for transactions (for example, if you have temporarily misplaced the card) click on the green square located on the bottom left corner of the card art.

- A box will pop up asking you to confirm that you wish to lock your card so it cannot be used. Click 'OK'

- Placing a lock on a credit card updates the account with real-time Lock/Unlock status.

PLEASE NOTE: The system recognizes when you, the cardholder, places a Lock on the card within the online website, and it will allow you to Unlock the card within the online website. HOWEVER, when a card has been Locked for any other reason (i.e. suspected fraud) you are not able to be Unlock it. This is for your protection. Please contact 1st CCU at 888-706-1228 or call Cardholder Services at 866-820-5786 if your card is in a locked status and you didn't lock it.

Report A Card Lost or Stolen

- Click the Lost/Stolen icon from the right-side navigation

- Click the appropriate radio button to indicate what happened, then click 'Next'

- Read the information in the box and click 'Continue'

- Fill in the information requested (please note, your contact information on your profile must be up-to-date to submit a lost/stolen request in DX Online)

- Complete all the information requested by the system, then click 'Submit'

WHAT YOU NEED TO KNOW ABOUT REPORTING A CARD LOST/STOLEN:

IF YOU HAVE AN INCORRECT ADDRESS ON FILE, YOU WILL NOT BE ABLE TO COMPELTE THE LOST/STOLEN REPORT WITHIN THE ONLINE SYSTEM. YOU WILL BE PROMPTED TO CONTACT 1ST COMMUNITY CREDIT UNION OR TO CALL THE LOST/STOLEN PHONE NUMBER (1-800-449-7728) TO REPORT YOUR CARD.

After the card is marked Lost/Stolen, the new card that is issued to you will automatically be added to your online user profile and the old card will be removed. It will not be necessary to manually add the new card when it arrives in the mail.

What are the security features of the system?

- You may be asked to provide information to verify your identity to perform certain functions within the system.

- To protect your account, a passcode may sent to you via Text or Email. Select your preference for receiving the passcode, then click 'Send'. The passcode will remain active for 10 minutes. Once you receive the 6-digit passcode you must enter it into the code field and click 'Submit'. Then follow the prompts on the screen.

- For security purposes the passcode may only be sent to the email or phone number of the Primary Cardholder.

Note: If you enter the passcode incorrectly too many times you will receive a message that the system is unable to verify your information and you'll need to contact the credit union or the Card Services number on the back of your credit card for assistance in resolving the lockout.

How Do I View The Privacy Policy:

A Privacy Policy defines how personal information is gathered and used by a financial institution. Click the Privacy Policy link at the bottom of the home page to view or print the policy.

Making A Payment

- From the Account Summary page, click the 'Make Payment' icon in the right-side navigation

- Review the Terms and Conditions and click to Accept them

- Select the Payment Account from the dropdown menu

- Select the Payment Date from the calendar

- Select the Amount To Pay

- Click the 'Next' button and the summary page will display

- Review the payment details. If they are correct, click 'Next'

- At the Authorization screen, review the information and click 'Authorize' to authorize the payment

- The Confirmation Screen will display the payment information you authorized. Click the 'Account Summary' button to return to your Account Summary dashboard.

To Add A New Payment Account

- Select the 'Make Payment' icon from the right-side navigation

- Accept the Terms and Conditions

- Click the 'Edit' link next to the 'Choose a Payment Account' field in the Payment Details box

- Click the 'Add New Account' button

- NOTE: If you have recently added or changed your payment source (within the last 5 days) you will receive a message letting you know that payments cannot be made until the system verifies your new payment account, which can take up to 5 calendar days from when you updated the account.

- If you are still okay with changing your payment account, click the 'Yes' button

- Select the Account Type from the dropdown menu. The routing number may pre-populate.

- Enter the full account number in the Account Number field, then enter it again in the Verify Account Number field.

- Click the 'Save and Next' button, then click 'Confirm' button

To Edit Your Payment Account

- Select the 'Make Payment' icon from the right-side navigation

- Click the 'Edit' link next to the 'Choose a Payment Account' field in the Payment Details box

- Click the 'Edit' link

- NOTE: If you have recently added or changed your payment source (within the last 5 days) you will receive a message letting you know that payments cannot be made until the system verifies your new payment account, which can take up to 5 calendar days from when you updated the account.

- If you are still okay with changing your payment account, click the 'Yes' button

- Edit the account number by entering the full account number in the Account Number field, then verify by entering it again in the Verify field

- Click the 'Save and Next' button, then click the 'Confirm' button

Automatic Payments Enrollment

- Select the 'Make Payment' icon from the right-side navigation

- Click the 'Enroll' button next to 'Automatic Payments' at the top of the Make Payment box

- Read and accept the Terms and Conditions, then click 'Next'

- Click the applicable radio button for 'Select an Amount to Pay', then click 'Next' (Note: the Statement Balance option is pre-selected. click the radio button if you want to enroll in another option. If you select 'Other Amount' you will need to enter a dollar amount in the field provided)

- Review the information and click the 'Next' button to continue, then read the Authorization statement before clicking 'Authorize' button

- You will get a confirmation screen. Click the 'Account Summary' button to return to your Account Summary dashboard

To Manage Automatic Payments

- Select the 'Make Payment' icon from the right-side navigation

- Click the 'Unenroll' link next to 'Automatic Payments' at the top of the Make Payment box

- Read the 'Cancel Automatic Payments' information and click 'Submit' to unenroll

To Unenroll from Automatic Payments

- Select the 'Make Payment' icon from the right-side navigation

- Click the 'Manage' link next to 'Automatic Payments' at the top of the Make Payment box

- Make the appropriate changes, click the 'Next' button, then review the information and click through to Authorize the changes

Payment Activity

- Click the 'Payment Activity' icon from the right-side navigation

- Cardholders can search for specific payments using the search function

- Using the dropdown arrow on the far right, you can see payment details

- Use the 'Show More' link at the bottom to see more payments

- The Payment Activity section shows Pending, Posted, Scheduled, and Canceled payments

- Cardholders can cancel a scheduled payment by clicking on the 'Cancel Payment' button of a scheduled payment in the list

Why Is My Minimum Payment Displaying Online Different Than What Appears On My Paper Statement?

The minimum payment displaying online could be different because it may or may not include any over limit or delinquent amount that is currently due to bring your account current.

When Should I Submit My Online Payment To Avoid A Late Fee?

Submit payments online before 6:00pm Central Time and it will post the next business day if paid from a 1st CCU account. Payment from another financial institution will take up to 10 business days for the first payment to be posted while the payment goes through verification. You may make a payment to your credit card as often as once per day. If you make two payments on your credit card in a single day, only the last payment will be posted to your account.

What Should I Do If My Last Payment Has Not Been Posted?

Call 1st Community Credit Union during regular business hours or the Customer Service telephone number on your statement.

Can cardholders make more than one payment per day?

No. If you make two payments on your credit card in a single day, only the last payment will be posted to your account.

Can cardholders cancel same-day payments?

No. Cardholders can only cancel future-dated payments or automatic payments.

How many days of transactions are available in the Transaction History?

Recent transactions are displayed by default and up to three previous statements' worth of transactions are available. If you search by Specific Date or Date Range you can search up to 180 days' worth of transactions.

Is the transaction history and balance information updated in real-time?

Yes. This includes the minimum amount due for credit cards, which reflects any payments made on the account before the due date.

What Do I Do If I Have Unauthorized Transactions On My Account?

Call 1st CCU immediately during regular business hours, or call the Customer Service number listed on the back of your card.

To Dispute A Transaction

You can dispute a transaction for any of the following reasons:

- Someone else used my card without my knowledge

- I was charged multiple times for the same purchase

- I was charged the wrong amount

- I have not received the product/service

- I received a product/service that was defective or not what I expected

- I cancelled this transaction

Follow These Steps:

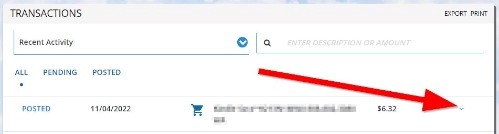

- On the Online Credit Card Management system's website, the Transaction List is displayed under the Account Summary. Find the transaction you wish to dispute in the transaction list.

- To dispute the transaction you can click on the little down arrow to the right of the transaction to expand the box. (see arrow in screenshot below)

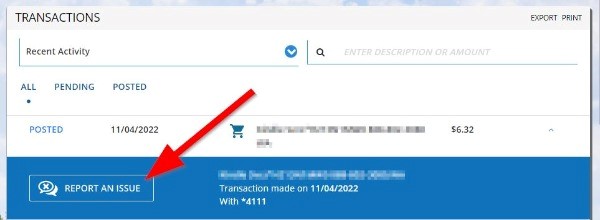

- Clicking the down arrow to the right of the transaction will expand the box, exposing the 'Report An Issue' button.

- Clicking the 'Report An Issue' button opens up the dispute dialogue box. Read the information in the box and click 'Continue' if you would like to file a dispute.

- Follow the steps and answer the information requested to complete the dispute, choosing the dispute reason, then answering all the questions asked.

- This may include clicking the radio buttons next to all transactions shown in the Dispute pop-up box that you did not authorize.

- The questions you are asked are based on the answers you provide, as a way for the system to get all the information it needs for the dispute.

- Provide all the information requested, then read the Summary screen before clicking 'Submit'.

- A confirmation screen will display when the request has been submitted.

- Our Credit Card processing vendor will review the dispute and contact you via email (or via letter if you have not provided your email address in the Credit Card Management profile) to get your signature on the dispute.

Statement Summary

- Clicking the Statements icon in the right-side navigation and scroll down the page to view a list of the statements available for you to view. Statements show the date your next statement will be issued, your card balance, the amount of purchases made on your card during the statement cycle, and the amount of any cash advances, the amount of any payments or credits during the statement cycle, the interest charged and any fees, and the new statement balance. You can also see the minimum payment due, and the next due date.

- On the left side of the Statement Summary is a link to enroll in eStatements if you are not already enrolled. eStatements are a secure way to receive your statement information, rather than letting your paper statement sit in your mailbox unattended and vulnerable to thieves.

Enroll in 1st CCU Credit Card eStatements:

- Click the Enroll link under Statement Summary

- Click to download the PDF (regulations require that you must prove that your device has the ability to view PDF statements).

- Copy or enter the code from the PDF and enter it in the confirmation field, then click 'Next'

- Read and accept the Terms and Conditions, then click 'Submit'

View, Print or Download Credit Card eStatements

- To print the eStatement without viewing it first, simply click the three-bar icon to the right and the Print button will display, then click the Print button and select the printer

- Locate the eStatements section of the Statement Summary section

- Click on the Document icon next to the statement you wish to view

- To manage eStatement delivery: Select the Statements icon, then click the 'Manage eStatements Delivery' link

- Enter the new email address and click 'Save'

Your CU Rewards Points balance is displayed in the Account Summary section of the Online Credit Card Management System, accessible within 1st CCU Anywhere.

To reach the online Credit Card Management System, log into 1st CCU Anywhere Online or Mobile Banking, click on your credit card in the Accounts section, then select “Credit Card” from the list of options.

- Click the Rewards balance to be linked to the CU Rewards website

- On the CU Rewards website you may redeem your points by clicking the 'Redeem' tab under the logo

- Cardholders may also review their CU Rewards Points balance on the Statement Summary screen by clicking on the Statements icon in the right-side navigation. The Rewards Activity section of the statement shows the beginning balance, the points earned during the statement cycle, any points redeemed during the cycle, and the new points balance.

Compatible Browsers for the new Online Credit Card Management website:

- Desktop browsers: Chrome and Microsoft Edge

- iOS (Mobile, Tablet) browsers: Safari/Chrome

- Android/Google (Mobile, Tablet): Chrome & Microsoft Edge

About the mobile-friendly navigation:

The credit card management website is built to be viewed in a web browser, there is no app to download. The site features responsive design. This means that the elements on the page (font, navigation pane) will resize to fit the screen you are using to access the site, whether it's desktop, tablet, or smart phone. For instance, when viewed on a desktop the navigation icons are on the right side, but when viewed on a smaller device the responsive design moves those navigation icons to the bottom.

New or Unknown Device Login:

- When you log into your profile using a device that has not previously been used for login, the DX Online system will prompt you for a 6-digit passcode. You may receive this passcode via email or text at the email address or the phone number on file for your card. The passcode remains active for 10 minutes. Enter the passcode in the field provided and click the 'Submit' button.

- Once you've correctly entered the passcode you have the option to allow the system to remember your device.

- Selecting YES to remember your device means you will not be prompted for a passcode when logging onto the system using that particular device

- If you are accessing from a public location you should select NO

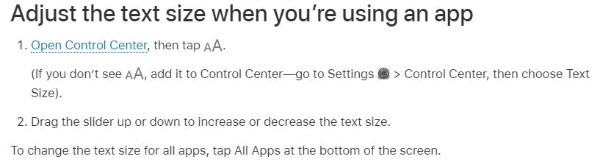

When viewing the Account Summary screen on my mobile phone the text for the due date and minimum due amount are overlapping, making them hard to read?

This is a known issue that mainly happens on some iPhones. One fix you could try is adjusting the settings of your text size.

As a 1st CCU Visa Credit Card holder, you are able to choose your own 4-digit Personal Identification Number, aka PIN.

To CHANGE the 4-digit PIN on a credit card that's already activated:

- Call 1-888-886-0083

- Answer authentication questions successfully

- Follow the call prompts to change your 4-digit PIN

To ACTIVATE CREDIT CARD AND SELECT 4-digit PIN:

- Call 1-800-631-3197 (inside U.S. & Puerto Rico)

- Call 1-531-262-5350 (outside the U.S.)

- Answer authentication questions successfully

- Card will be activated, then follow call prompts to enter your chosen 4-digit PIN

Use the phone numbers listed below for additional Credit Card service or to report your credit card lost or stolen:

Monday-Friday 8am – 5pm

1-888-706-1228

Evenings and Weekends

1-866-820-5786