How can I securely send documents or sensitive information to 1st CCU?

Use our ZIX Secure Email whenever you need to securely send messages or documents to an employee at 1st Community Credit Union. All information sent via ZIX Secure Email is encrypted, so your social security number, account numbers, and other sensitive personal identification information will be safely transferred. It's easy to use, just click the button above to go to the ZIX Portal and register (or sign in if you already have a ZIX account) to get started.

Secure Email Instructions For Computer

Secure Email Instructions For Cell Phone

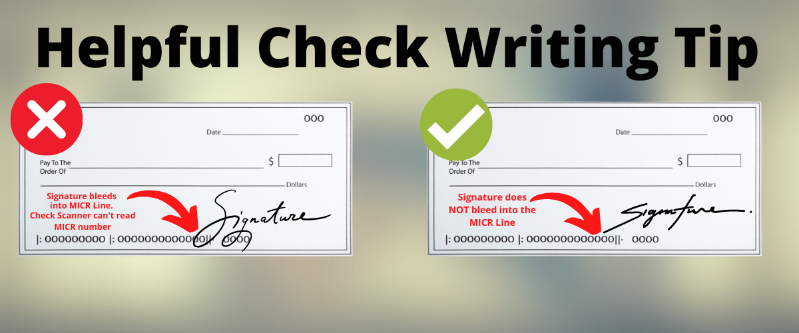

Is there a RIGHT way and a WRONG way to sign the checks I write?

When you are signing a check you've written, please be aware that you should avoid letting your signature interfere with the MICR line. The MICR line is the series of numbers printed at the bottom of your check. The numbers are printed in magnetic ink and they represent the credit union's routing number, your account number, and the number of the check you are writing. When a check is being processed it is scanned by a MICR Reader, and if your pen has strayed into that MICR number when you signed your name the pen marks interfere with the proper scanning of the check. Keeping your signature away from the MICR line helps you and the credit union!

What do I need to know about setting up automatic loan payments?

When you sign the form to authorize payment transfers to your loan, the transfers are set up in the system to happen on the day(s) you request and those payments happen automatically. The system will not check to see if a payment has already been made to the loan during the month.

So, if you decide to make your loan payment in person or via online banking transfer, you need to be aware that the scheduled automatic payment is still going to come out of your account also.

If you need to make a change to your scheduled automatic payment transfer please contact 1st CCU to submit a revised authorization form.

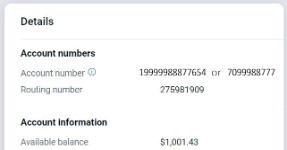

Direct deposits are a convenient way to receive funds! To avoid delays in receiving your deposit, follow these steps:

1. Log into 1st CCU Anywhere Online Banking or Mobile App.

2. Click into the account you want your direct deposit to go into.

3. Scroll down and look for the 'Detail' section within your account. You will see either a 14-digit or a 10-digit account number and 1st CCU’s routing number.

4. Provide the account and routing numbers on the paperwork you are submitting to authorize your employer or other entity to make direct deposits of funds into your account.

Please contact 1st CCU for assistance if you have questions about authorizing a direct deposit.

Automatic Clearing House (ACH) withdrawals can be a convenient way for you to authorize a company or utility to receive funds from your account to pay a bill. Please note that if you set up automatic withdrawal transactions from your account and you need to stop the automatic withdrawal, you should first contact the company that you authorized to do the withdrawal and tell them to stop payment.

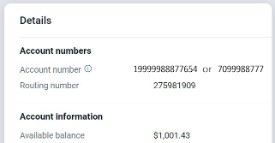

1. Log into 1st CCU Anywhere Online Banking or log into the 1st CCU Anywhere Mobile App.

2. Click into the account you want your automatic withdrawal to come out of (i.e. Share Draft Checking)

3. Scroll down and look for the 'Detail' section within your account. You will see either a 14-digit or a 10-digit account number and 1st CCU’s routing number.

4. Provide the account number and routing number on the paperwork you need to submit to the merchant, utility company, or other organization whom you are authorizing to automatically withdraw funds from your account.

Please contact 1st CCU for assistance if you have questions about authorizing an automatic withdrawal.

What are the debit card withdrawal and purchase limits?

The answer depends on the circumstances...

Normally your debit card is subject to the following:

- ATM withdrawals are limited to $400 per day, subject to the available funds in your account.

- For purchase goods and services at Point-of-Sale (POS) you may not exceed $3,000 per day, subject to the available funds in your account. (If you will be doing a one-time purchase that exceeds this POS limit, please contact 1st Community Credit Union in advance to request a temporary limit increase)

However, for security purposes:

- Some restrictions may apply if you are performing transactions or cash withdrawals in countries or geographic areas experiencing high levels of fraud. These restrictions may include:

- lower ATM limits ($205 per 24 hours at an ATM, including ATM fee)

- lower purchase limits ($500 per 24 hours)

- inability to pay at the pump in some states (you may be required to go inside to pay with the cashier in some states)

- Some debit card restrictions may apply whenever an ATM is in standby mode:

- Standby ATM may temporarily lower withdrawal limit to $100

- Debit card Point-of-Sale transaction limits may be affected by routine system maintenance

- point-of-sale transactions during system maintenance may be temporarily limited to $1500

WHAT DO I NEED TO KNOW ABOUT MY ESCROW?

Here are answers to some Frequently Asked Questions about Escrow Accounts:

- What is the Escrow Account Disclosure Statement?

- This statement will show the previous year activity on your escrow account to include all payments into the account, and made from the account, for property taxes and homeowner's insurance.

- What is the Escrow Analysis?

- This document includes the anticipated amounts to be paid out of your escrow account over the next twelve months and includes the mathematical calculation to allot for the correct funds being withheld in the account.

- What is the Automatic Payment Authorization Form?

- This form can be used to update your existing automatic payment amount for your mortgage loan payment or to set up a new one. You may receive this form if the annual Analysis indicates that a payment change needs to be made. Please feel free to contact 1st CCU for assistance in making any updates regarding your payments.

- When do I receive the Escrow Account Disclosure and the Escrow Analysis?

- We analyze each member's escrow account before the beginning of March each year, then we send the statement and the analysis.

- I have extra money in my escrow account and my taxes and insurance have been paid, can I withdraw those funds?

- No, an escrow account is not a transaction account and the balances are based on several factors. After the Escrow Analysis if your account has an overage in excess of $50 you will receive a check for those overage funds.

- What if I don't have enough in my escrow account?

- If your account has a shortage your analysis will calculate for the adjustment needed on your future payments.

- An Automatic Payment Authorization Form will be mailed out with your Escrow Analysis if a payment change is necessary.

- Please complete the form and return it to 1st CCU. If you need assistance please feel free to contact the Mortgage Processing Department at 888-706-1228 extension 2516.

- If you have an automatic payment set up, it's a good idea to make sure you are adjusting that to cover the correct payment.

- If you wish to keep your payment as is, you do have the ability to make a one-time deposit for the shortage amount.

- If your account has a shortage your analysis will calculate for the adjustment needed on your future payments.

- How will I know that my Taxes/Insurance were paid?

- You may look in the escrow account history to see if payments were made. This will show any deposits into, and withdrawals out of, the account.

- Is there any other reason the amount going into my escrow account could be changing?

- Yes, for example if you have been making payments that aren't consistent with the monthly cycle. (i.e. you make bi-weekly payments). Since the system is set up to compute based on a monthly payment cycle, payments that differ from this cycle may affect the calculations. If you are encountering this issue, please contact the Mortgage Loan Processing Department to discuss options by calling 888-706-1228 extension 2516.